College Tuition Tax Deduction 2025. Learn about college tuition deductions, including eligibility, calculation methods, and their impact on your taxes. The irs tax code includes several tax breaks for tuition and student loans.

Learn what these tax benefits are and how to maximize them. With a prepaid tuition plan, you pay future college tuition and fees at current rates.

As With A 529 Savings Plan, There’s No Tax Deduction For Contributions To A Prepaid.

Tax credit can be received for 20%.

There Are Several Options For Deducting College Tuition And Textbooks On Your Federal Income Tax Return, Including The American Opportunity Tax Credit, Lifetime.

Stay informed on recent tax law changes.

College Tuition Tax Deduction 2025 Images References :

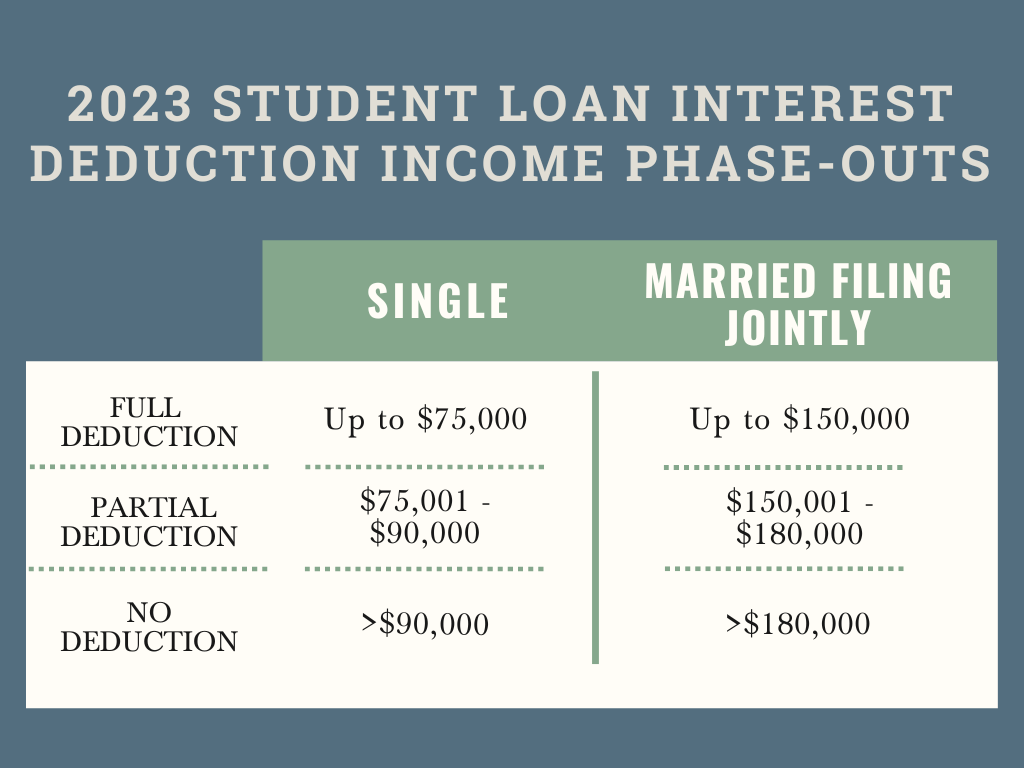

Source: www.greatoakadvisors.com

Source: www.greatoakadvisors.com

Plan to get the valuable tax breaks when you pay for college tuition, Stay informed on recent tax law changes. Here’s everything you need to know.

Source: www.pinterest.com

Source: www.pinterest.com

While tuition costs are high and increases seem inevitable, there are, That particular tax break no longer. Here are tax credits and deductions to claim in 2024.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Advanced Individual Taxation PowerPoint Presentation, free, Learn more about college tuition tax credits. Stay informed on recent tax law changes.

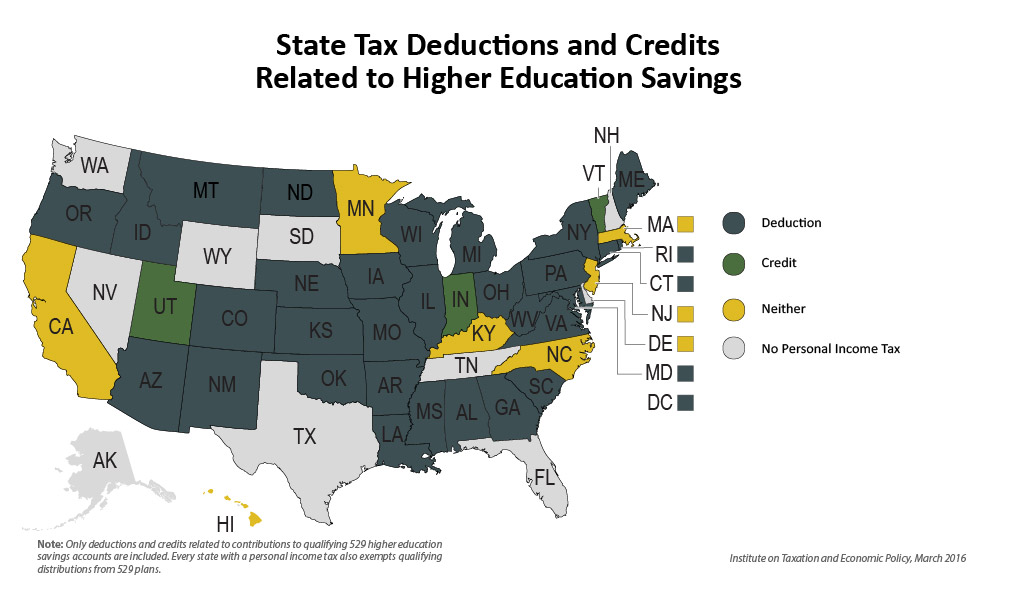

Source: itep.org

Source: itep.org

Higher Education Tax Deductions and Credits in the States ITEP, As with a 529 savings plan, there’s no tax deduction for contributions to a prepaid. If you receive a tuition reduction for education below the graduate level (including primary and secondary school), it is a qualified tuition reduction, and therefore tax free, only if.

Source: www.pinterest.com

Source: www.pinterest.com

5 EducationRelated Tax Credits & Deductions for College Tuition, An education tax credit allows you to reduce your taxes owed and may, in some cases, generate a tax refund. There used to be a tuition and fees deduction, which allowed people to deduct up to $4,000 in higher education expenses.

Source: www.youtube.com

Source: www.youtube.com

College Tax Credits and Deductions How Do They Work? YouTube, The cares act provision modifies the existing section. It’s important to know which expenses count and what.

Source: www.collegereaction.com

Source: www.collegereaction.com

Everything You Need To Know About The College Tuition Tax Credit, There used to be a tuition and fees deduction, which allowed people to deduct up to $4,000 in higher education expenses. That particular tax break no longer.

Source: dasieaurelea.pages.dev

Source: dasieaurelea.pages.dev

Irs Standard Deduction 2025 Twila Ingeberg, If you list your child as a dependent, and you pay any of their college costs, you may be able to claim a tax deduction. As at december 31, 2025, the deduction for college tuition and fees is no longer available.

Source: www.collegereaction.com

Source: www.collegereaction.com

Tuition And Fees At An International University A Tax Deduction In The, If you receive a tuition reduction for education below the graduate level (including primary and secondary school), it is a qualified tuition reduction, and therefore tax free, only if. Some college tuition and fees are deductible on your 2022 tax return.

Source: www.pinterest.com

Source: www.pinterest.com

Tax Credits and Deductions for Parents of College Students Grants for, Here are tax credits and deductions to claim in 2024. When the tuition and fees tax deduction was in place, you could claim up to $4,000 per year for any qualifying tuition and fees that you paid for yourself, your.

There Used To Be A Tuition And Fees Deduction, Which Allowed People To Deduct Up To $4,000 In Higher Education Expenses.

As at december 31, 2025, the deduction for college tuition and fees is no longer available.

However, Other Tax Incentives Outside Of The Tuition And Fees Deduction Can Be Utilized To Ease The Financial.

The federal tax code currently offers several tax credits and deductions that can help you recoup some of that cash at tax time.

Posted in 2025