Tax Free Gift Amount 2024. For married couples, the limit is $18,000 each, for a total of $36,000. The annual gift tax exclusion will be $18,000 per recipient for 2024.

This means that you can give up to. The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

2 You’ll Have To Report Any Gifts You Give Above.

Starting january 1, 2024, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.

For Married Couples, The Limit Is $18,000 Each, For A Total Of $36,000.

This amount is $1,000 greater than the exclusion in 2023 (which was also $1,000 greater than the amount in.

In Addition, The Estate And Gift Tax Exemption Will Be $13.61 Million Per Individual For 2024 Gifts And Deaths, Up From $12.92 Million In 2023.

The annual gift tax exclusion will be $18,000 per recipient for 2024.

Images References :

Source: www.businesstoday.in

Source: www.businesstoday.in

tax on gifts Know when your gift is taxfree BusinessToday, Gifting more than this sum means you must. For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025). For married couples, the limit is $18,000 each, for a total of $36,000.

Source: www.carboncollective.co

Source: www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation, In 2024, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. Page last reviewed or updated:

Source: www.carboncollective.co

Source: www.carboncollective.co

Gift Tax Exemption 2022 & 2023 How It Works, Calculation, & Strategies, Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000. For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Source: www.pinterest.com

Source: www.pinterest.com

What Is The Gift Tax And How Much Can You Gift TaxFree? Tax, Tax, Starting january 1, 2024, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person. The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2024.

Source: pkcindia.com

Source: pkcindia.com

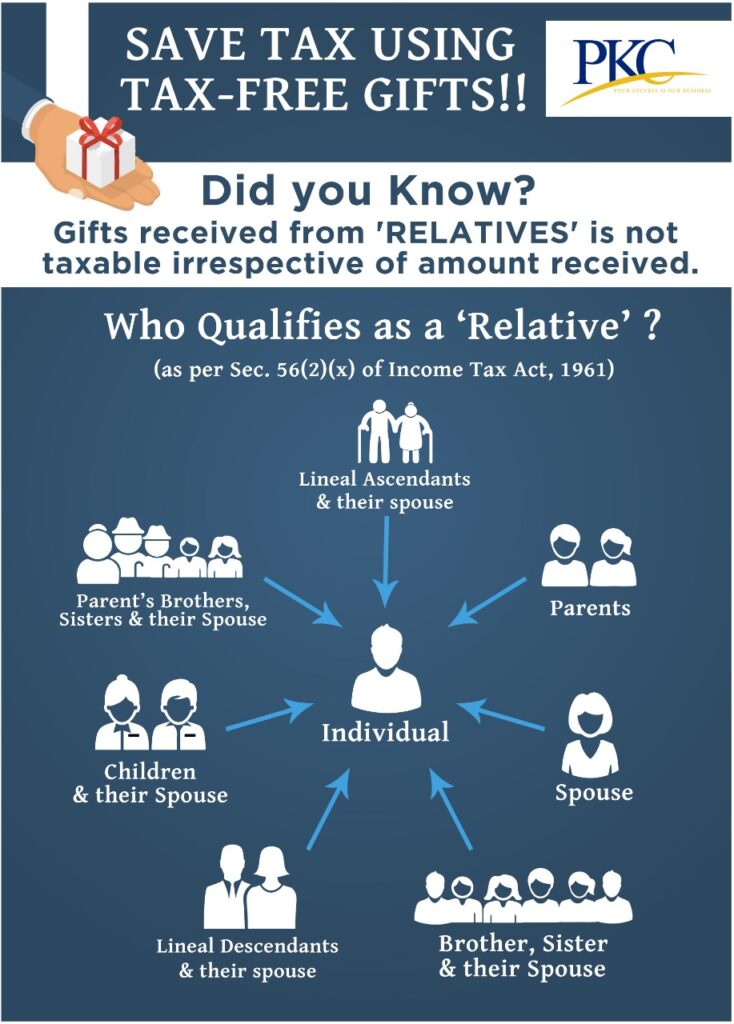

Tax Free Gifts Blog PKC Management Consulting, For 2024, the annual gift tax exemption is $18,000, up from $17,000 in 2023. This amount is $1,000 greater than the exclusion in 2023 (which was also $1,000 greater than the amount in.

Source: mpmlaw.com

Source: mpmlaw.com

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The annual gift tax exclusion will be $18,000 per recipient for 2024. For married couples, the limit is $18,000 each, for a total of $36,000.

Source: crixeo.com

Source: crixeo.com

TaxFree Gifts What Is It And How Much Can You Give? Crixeo, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient. The annual gift tax exclusion will be $18,000 per recipient for 2024.

Source: www.claritasfinancialpartners.com

Source: www.claritasfinancialpartners.com

5 Ways to Give TaxFree Gifts Brian Lynn, In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023. For a married couple, this means they can jointly gift $36,000 to a single recipient without incurring gift taxes.

Beginning On January 1, 2024, An Individual May Make Gifts In An Amount Up To $18,000, In Total, On An Annual Basis To Any Recipient Without Making A Taxable Gift,.

For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

In Addition, The Estate And Gift Tax Exemption Will Be $13.61 Million Per Individual For 2024 Gifts And Deaths, Up From $12.92 Million In 2023.

This limit is adjusted each year.

The Annual Gift Tax Exclusion Will Be $18,000 Per Recipient For 2024.

Gifting more than this sum means you must.